The Single Strategy To Use For Paul B Insurance

Paul B Insurance - The Facts

Whether you have a bronze health insurance plan, a high-deductible health insurance, or a Medicare Part C plan, they will all fall under these standard classifications initially. We'll clarify the primary types of medical insurance and examples. A couple of major sorts of health insurance, public wellness insurance is supplied through a federal government program, like Medicare, Medicaid, or CHIP.

Simply like personal health insurance plans, which we'll speak about following, federal wellness insurance policy programs try to take care of quality and also expenses of treatment, in an initiative to offer decreased prices to the insured. They may not be as high as with various other kinds of insurance policy.

Medicaid and also CHIP are run by each state. While there is no registration period, there are economic requirements to qualify., the other primary type of wellness insurance policy.

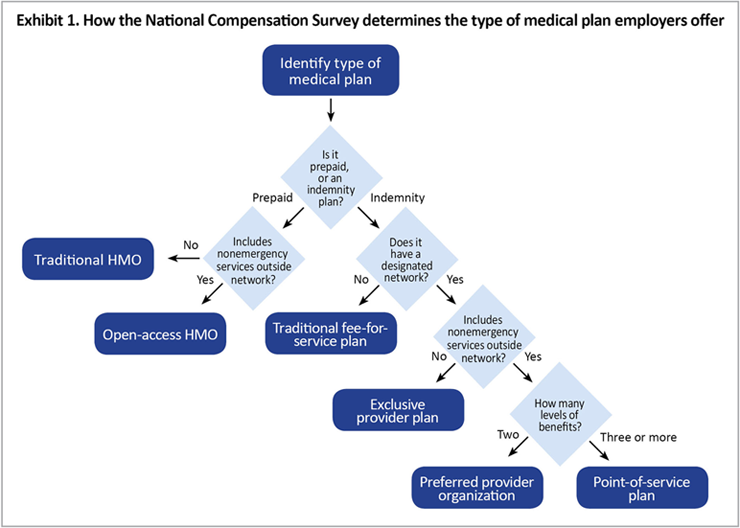

After you've identified the main type of medical insurance based on its resource, you can additionally classify your coverage by the sort of plan. Most health and wellness insurance coverage policies are handled care strategies, which simply implies the insurance provider collaborate with various clinical carriers to develop as well as bargain expenses and also quality of treatment.

3 Simple Techniques For Paul B Insurance

(HDHP), which allows the insured individual to open up an HSA account, might be an HMO with one insurer, as well as an EPO with one more.

Some sorts of health and wellness insurance policy, like short-term strategies, do not give thorough protection as outlined by the Affordable Care Act and also therefore are not controlled by it either. Brief term health and wellness insurance coverage is ruled out a type of major clinical insurance policy, yet just a substitute measure suggested to cover a few, yet not all, clinical expenses. Still, selecting medical insurance can be hard work, also if you're selecting a plan through your company. There are a lot of complicated terms, and the process forces you to concentrate about your health and wellness and your funds. Plus you need to navigate all of it on a deadline, often with only a few-week duration to explore your options and make decisions.

Asking yourself a couple of easy concerns can help you no in on the ideal plan from all those on the marketplace. Right here are some ideas on where to look and exactly how to obtain reliable guidance as well as help if you need it. It's not constantly evident where to look for health and wellness insurance policy.

, where you can shop for insurance in the markets produced by the Affordable Care Act, likewise known as Obamacare.

More About Paul B Insurance

Also with lots of alternatives, you can tighten points down with some basic inquiries, De, La, O states. If you're rather healthy, any of a range of plans might work.

"If there's a strategy that does not have your service provider or your medications in-network, those can be removed," he claims. Occasionally you can go into in your drugs or physicians' names while you browse for strategies online this page to filter out plans that won't cover them. You can also just go right here call the insurer as well as ask: Is my provider in-network for this strategy I'm considering? Is my medicine on the plan's formulary (the list of drugs an insurance policy plan will cover)? There are likewise 2 major different sorts of plans to take into consideration.

A Wellness Upkeep Organization has a tendency to have a stringent network of suppliers if you see a supplier outside of the network, the costs are all on you. A Preferred Service provider Company "will offer you a lot broader selection of providers it could be a little much more expensive to see than an out-of-network service provider, but they'll still cover some of that cost," she discusses.

If you chose that strategy, you 'd be betting you will not need to utilize a great deal of health and wellness solutions, and so would only have to stress over your ideally cost effective costs, and the prices of a couple of consultations. If you have a persistent medical problem or are merely even more risk averse, you might rather choose a plan that has dialed up the amount of the premium.

Paul B Insurance Things To Know Before You Buy

In this way, you can go to a great deal of visits and also grab a great deal of prescriptions as well as still have convenient month-to-month prices. Which strategies are available as well as budget-friendly to you will certainly differ a whole lot depending upon where you live, your earnings and who's in your house and also on your insurance coverage plan.

gov or onyour state's ACA official source insurance exchange. Still feeling overwhelmed with all the ACA options? You're in good luck. There is totally free, impartial expert assistance readily available to assist you select and register in a plan. Just placed in your postal code at Medical care. gov/localhelp and search for an "assister" an individual likewise described as a healthcare navigator on some state sites." Aaron De, La, O is one such navigator, and keeps in mind that he as well as his fellow overviews don't deal with commission they're paid by the federal government.

The net can be a scary place. Corlette says she cautions individuals: Do not put your get in touch with information in health and wellness insurance interest forms or click on online advertisements for insurance policy!

"Sadly, there are a lot of disadvantage artists out there who take benefit of the fact that individuals recognize health and wellness insurance coverage is something that they need to get," claims Corlette. She informs people: "Just go straight to Health care.

Little Known Facts About Paul B Insurance.

This year, the indicator up period for the Health, Care. gov market prepares that go right into impact in January 2022 starts Nov. 1, 2021 and runs till Jan. 15, 2022. If you're signing up for an employer-sponsored strategy or Medicare, the deadlines will be different, however most likely additionally in the fall.